This is why insurance binders typically last 30 to 90 days - you need the temporary coverage until you can finalize a more long-term policy. In this case, your carrier may issue an insurance binder so you can meet the insurance requirements for closing on an auto loan. For example, an insurance binder may be necessary if your car insurance application is undergoing extended consideration because your driving history carries multiple DUIs. In these cases, an insurance binder would be useful.

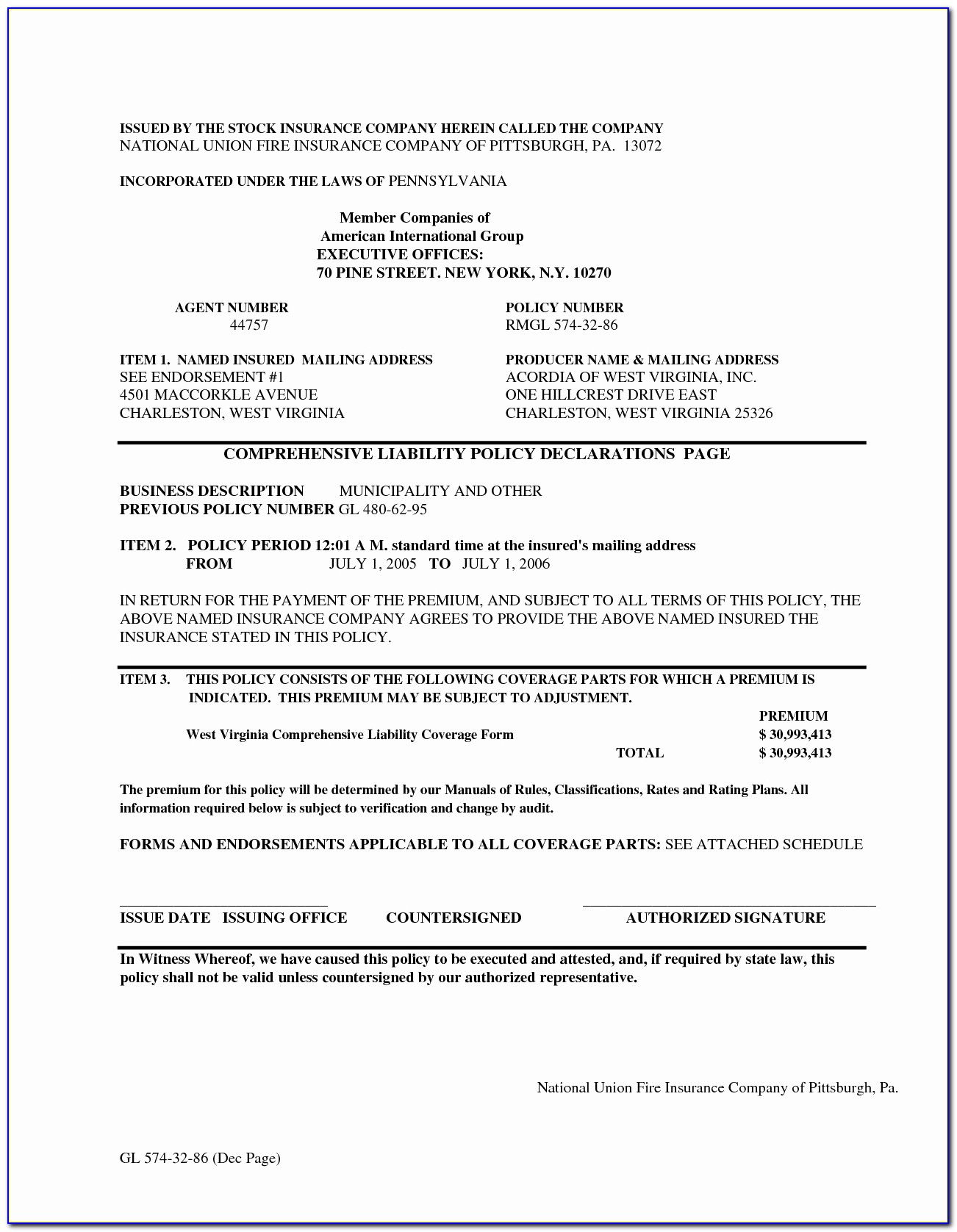

Similarly, you can get an insurance binder if your lender requires proof of coverage before closing on your new car’s auto loan.Īpplication turnarounds can sometimes stretch out depending on your background and risk profile. After your main policy is finalized, its coverage takes over and the binder expires. For example, you can get a home insurance binder to meet the insurance requirements for closing on a mortgage loan. If you need an insurance binder from an insurer, or you are an insurer and need to collect binder details from multiple clients, then this insurance binder template will do the work for you.Binders are generally used when you finance your car, home or commercial property and you need immediate coverage while your official policy is being finalized. Note that an insurance binder will only last for about 30-90 days before it expires hence there's always need to follow up with your insurer until a formal insurance policy is issued. then you will definitely need an insurance binder. Who needs an insurance binder, or when will I need an insurance binder, If you are purchasing a new insurance policy, using a loan to finance your property, or purchasing a new home/car etc. Not everyone needs an insurance binder, and this also brings up questions like Many who see this template ask questions like: What is an insurance binder, What Is Included in a Binder or what's the difference between a Binder and a Certificate of Insurance.Īn insurance binder (also called Insurance policy binder, Title binder, Interim binder, insurance card) is a temporary contract that guarantees the binder holder of full insurance coverage pending the formal issuance or a rejection of the insurance policy.

0 kommentar(er)

0 kommentar(er)